Tax Planning is a systematic evaluation of finances and investments, to reduce the tax burden in a legitimate way. It involves understanding the tax implications of various cash inflows and outflows such as salary composition, property income, home loan, investments, sale or purchase of assets, gifts and interest-bearing deposits, to draw up an appropriate investment strategy that allows realization of financial goals while at the same time reducing tax liability to minimum.

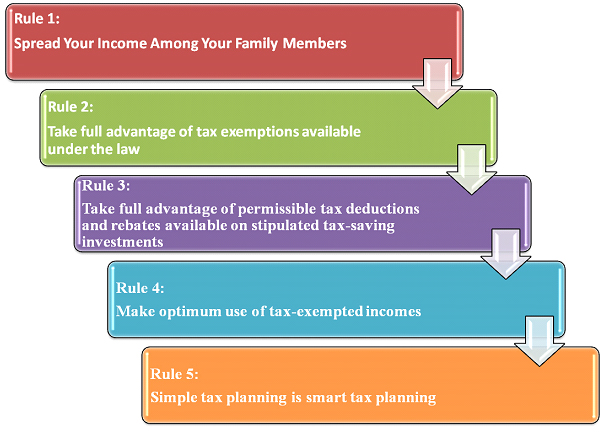

Golden Rules of Tax Planning